If you’d like to listen to this week’s Bass Bites, click on the player below:

Global week in review

A good start to the Q2 US earnings reporting season supported global stocks last week, despite a firm US inflation report and ongoing tariff threats from President Trump.

US tariff levels inch above market expectations

With markets becoming increasingly numb to Trump’s persistent tariff threats, equities managed to squeeze out a small gain last week thanks to encouraging earnings reports.

Trump made a series of threats last week against Europe and announced a deal that will see Indonesian goods entering the US face a 19% tariff. The latter is consistent with the emerging view that the average tariff level the US sets looks closer to being 15-20%, rather than the 10% baseline originally hoped for by markets. Rumours also swirled (yet again) around Trump’s desire to sack Fed chair Jerome Powell – which still does not seem likely.

Earnings support stocks

According to FactSet meanwhile, 83% of the 12% of S&P 500 companies that have reported earnings so far have beat expectations. This is a touch above the 5-year average beat of 78%. Perhaps ironically, recent financial market volatility – thanks to tariff concerns – may have helped boost the trading income of several major financial companies, which usually lead off the US earnings reporting season.

Other supportive factors last week were Federal Reserve Board member Chris Waller trying hard to get Trump’s attention – as a possible Powell replacement – by arguing for a July rate cut yet again. To my mind, if anything, Waller’s paper-thin argument for a near-term rate cut is so obviously political it already undermines his economic credibility. But welcome to the new America!

The one key piece of US economic data last week was the June CPI report. Headline inflation rose 0.3%, in line with market expectations, while core prices rose 0.2%, or a little less than expected. Although there were some early signs of tariff effects feeding through into clothing and furniture prices, combined softness in car prices, housing and services helped keep overall price gains limited.

Outside of the US, Chinese GDP rose a slightly better than expected 1.1% in Q2, despite ongoing tariffs concerns and an ailing property sector. Indeed, as noted by BHP last week, Chinese demand for our key commodity exports remains resilient, reflecting still firm domestic demand and exports.

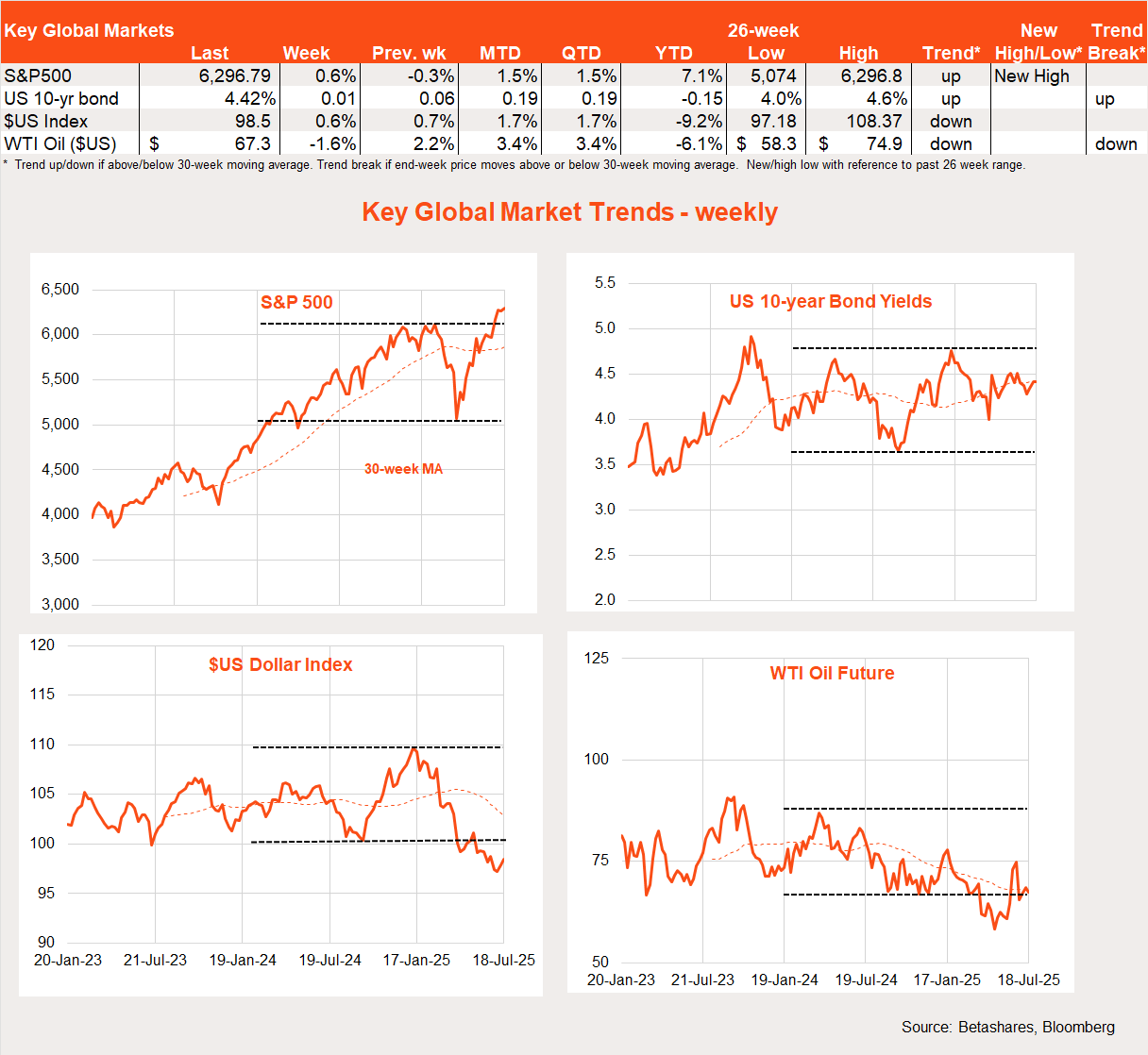

Global market trends

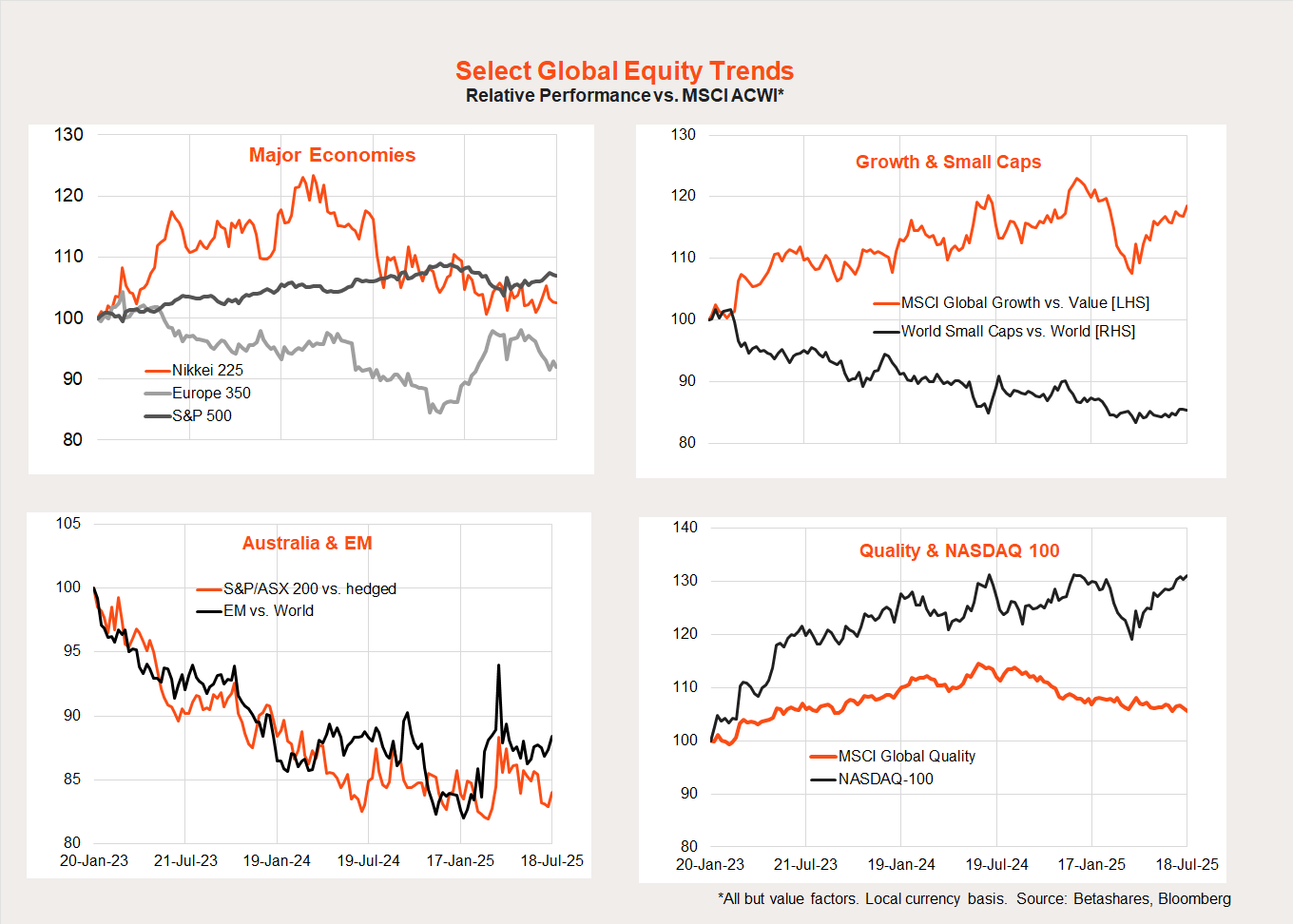

Growth and technology had another good week despite the overall US market not outperforming non-US markets.

The main trend of note over recent months has been the rebound in US/growth/technology relative performance, in line with the market bounce back since early April. Despite the risk-on tone over this period, small caps have refused to outperform so far.

Global week ahead: US inflation test

It’s a relatively quiet week for global markets, with US durable goods and a speech by Fed chair Powell being the main US highlights. The European Central Bank meets and is expected to leave rates on hold. In terms of earnings, reports from Alphabet and Tesla on Wednesday headline the week.

Note, according to FactSet, overall earnings for S&P 500 companies are expected to have risen 5.5% in the year to end-June, although the Mag-7 are expected to have grown earnings 14.1% – leaving earnings among the other 493 companies up only 3.4%. So while the Mag-7 account for around one third of the S&P 500’s market capitalisation, they’re also accounting for around 40% of its earnings growth over the past year.

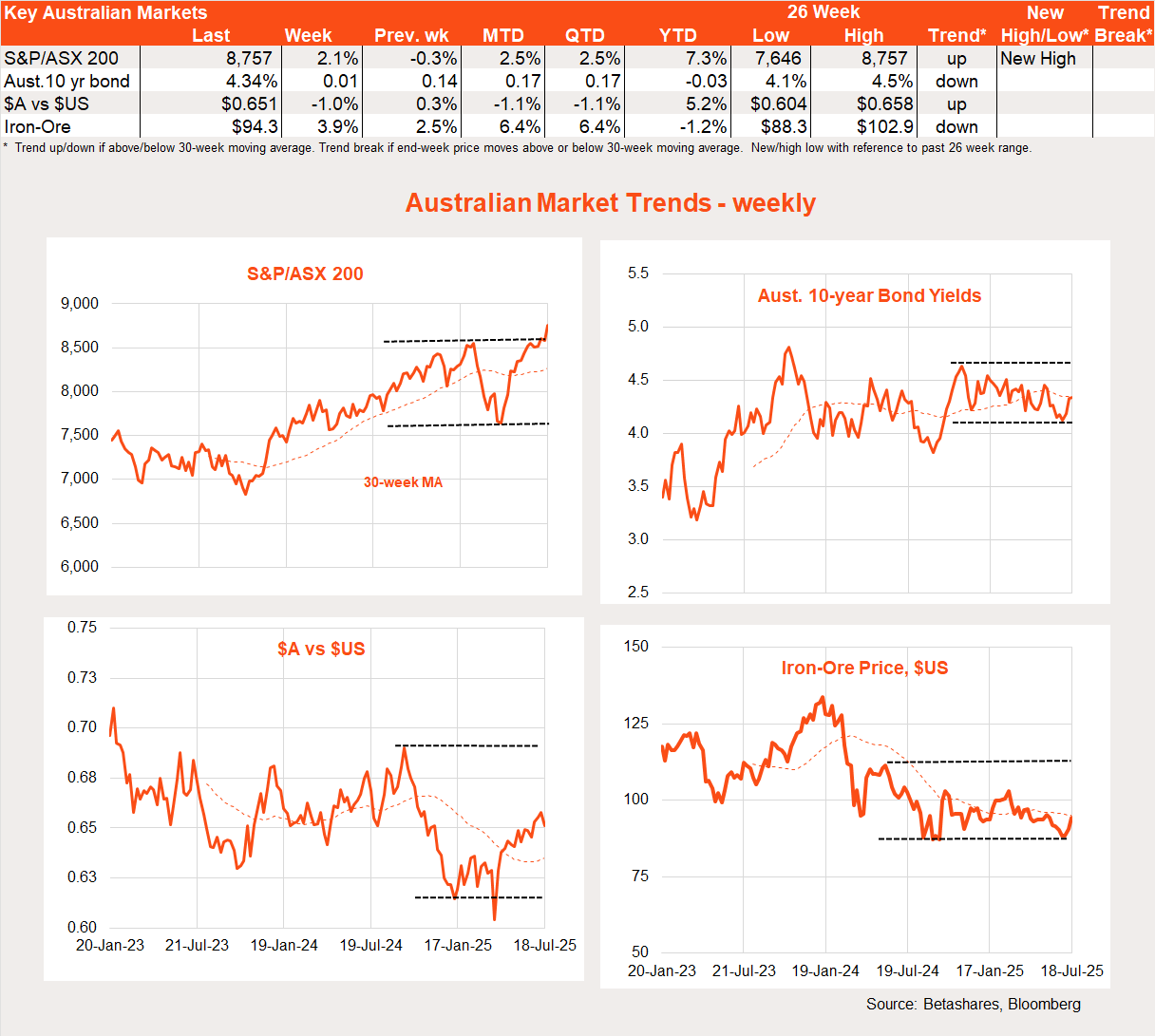

Australian week in review

Local stocks enjoyed a good week with the S&P/ASX 200 up 2.1%, supported by heightened rate cut expectations.

The main local data highlight was the weaker-than-expected labour market report, with employment up only 2k in June and the unemployment rate rising from 4.1% to 4.3%.

Although monthly employment growth can be volatile, it was the second successive soft result, although this did follow a bumper employment gain in April. All up, however, it does suggest tentative signs of some softening in labour market conditions, which adds to the case for an RBA rate cut next month – provided next week’s Q2 CPI result is not too high. Provided annual trimmed mean inflation is no more than 2.7% next week – as I expect – it would seem a done deal that the RBA will cut rates in August.

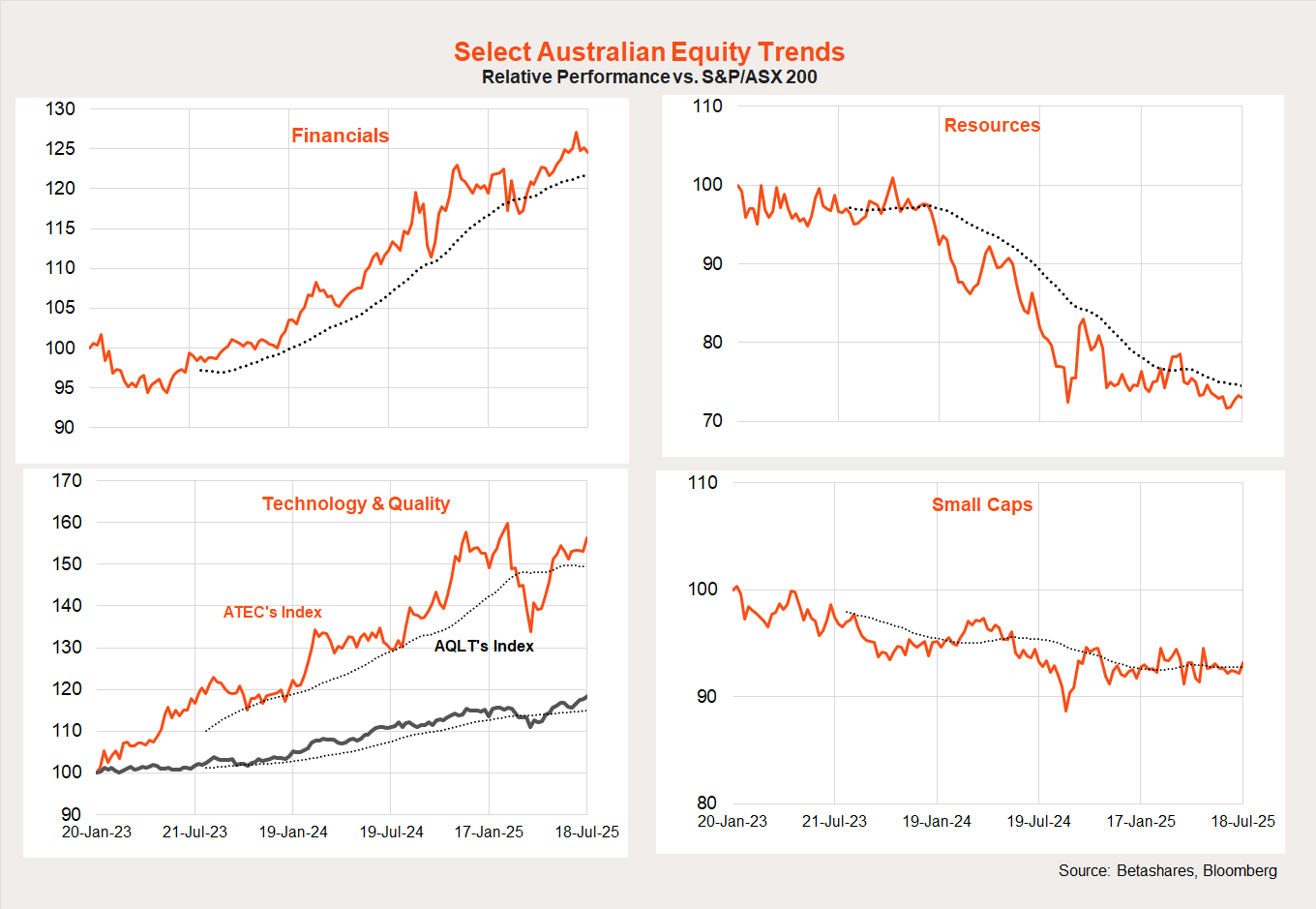

Just for interest, below are some of the major sector trends within the Australian market. As evident, financials have beaten resources since early 2023, while technology and quality have also done well. As is the case globally, small caps are so far refusing to outperform in this upswing.

Australian week ahead

There’s little on the local data front this week with minutes to the recent RBA Board meeting tomorrow being the main highlight.

These should tell us what we already know – namely, the Bank chose to leave rates steady this month as it, not unreasonably, wanted to wait for confirmation of low inflation in next week’s Q2 CPI report.