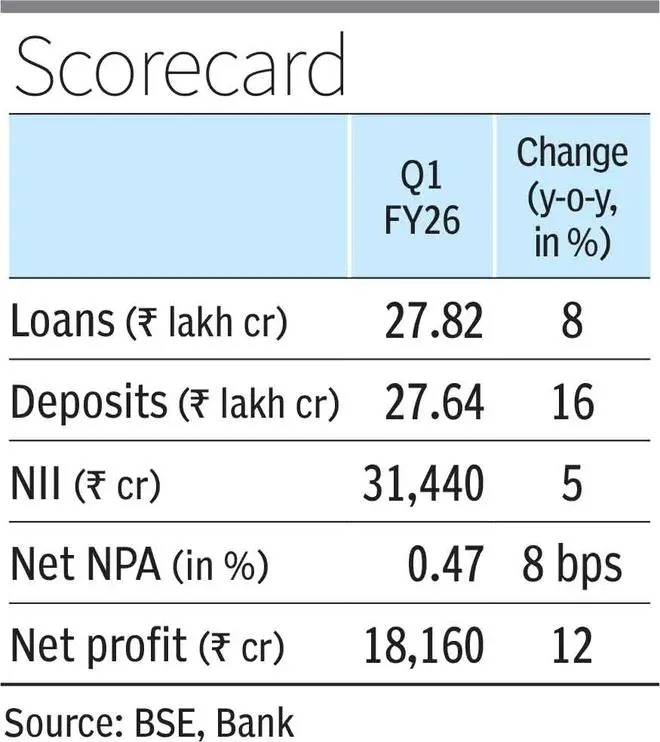

The country’s largest private sector lender HDFC Bank on Saturday reported 12 per cent year-on-year (y-o-y) and 3 per cent quarter-on-quarter (q-o-q) rise in net profit for the quarter ended June at ₹18,160 crore, largely led by surge in other income.

The bank’s other income more than doubled y-o-y to ₹21,730 crore in Q1, while net interest income grew 5 per cent y-o-y to ₹31,440 crore. HDFC Bank said its credit performance across all segments continues to remain steady, in a credit environment that stays benign.

Accordingly, it considered this period as an opportune stage to enhance its floating provisions, which, according to bank management, are not specific to any portfolio, nor meant for any specific anticipated risks, but act as a countercyclical buffer for making the balance sheet more resilient.

Overall, HDFC Bank made floating provisions of ₹9,000 crore of and additional contingent provisions of ₹1,700 crore during the quarter. To be sure, HDFC Bank made transaction gains of ₹9,130 crore from a partial divestment through an offer for sale in the recent IPO of its subsidiary HDB Financial Services and used the proceeds for building higher provisions.

The bank’s board also declared a special interim dividend of ₹5 per equity share and approved issuance of bonus shares in the proportion of 1:1. This the first time that HDFC Bank has issued a bonus share and the bank’s CFO Srinivasan Vaidyanathan clarified that the lender is unlikely to approve bonus issuance of shares each year.

Core business

HDFC Bank’s advances grew 8 per cent y-o-y to ₹27.82 lakh crore, while deposits rose 16 per cent to ₹27.64 lakh crore. 57 per cent of the bank’s advances are retail in nature and the rest are corporate loans. The bank continues to witness pricing issues with top corporate loans, but is confident of growing overall loan book on-par with broader industry in the current fiscal.

Net interest margin (NIM) dipped further to 3.35 per cent in Q1 from 3.46 per cent in previous quarter. Considering that the Reserve Bank of India (RBI) has cut repo rate by 50 basis points in its last monetary policy committee meeting, assets will re-price faster than deposits and could hurt the bank’s margin further.

“…When you have repo-linked loans like mortgage, SME and some corporate loans, it will have a lead and a lag impact. With current environment, there is uncertainty on where the rates are going. If the rates are steady, it provides opportunity to settle both sides of balance sheet…,” Vaidyanathan said when asked about margin trajectory going ahead.

Lastly, the bank’s asset quality showed some deterioration, with fresh slippages rising to ₹9,000 crore in Q1 from ₹7,500 crore last quarter. The CFO said slippages came from the agriculture sector mainly but did not elaborate details on other loans that slipped into non-performing asset (NPA) category. Overall gross and net NPA of the bank rose to 1.40 per cent and 0.47 per cent in Q1 against 1.33 per cent and 0.43 per cent last quarter, respectively.

Published on July 19, 2025