If you’re keen to explore merger and acquisition opportunities, I suggest focusing on one commodity, in particular. It just seems the highest probability thematic currently.

Yesterday we touched on the notion that commodity producers can generate huge cash flow when prices are high.

Right now, that’s happening in the gold sector.

Case in point is Genesis Minerals ($GMD). They released their quarterly update this morning.

Gold in Aussie dollars is around $5000 an ounce. Their cost to produce is about $2,500. GMD just put in a record June quarter in terms of production too.

Put all together, and GMD made $125 million in free cashflow from operations in the last 3 months. Nice work if you can get it.

Now, it must be said, in this instance, that GMD are spending big money on acquisitions and exploration.

That cash came in, and was already earmarked to go out the door.

However, the broader point stands: there are big cash flows flowing through the gold sector currently.

Now, it’s time to think about the downstream effects of this…

For example…

One is the mining service companies.

They will keep winning contracts as the gold miners keep ramping up production to cash in on high gold prices. That supports their share prices.

Another is gold developers and explorers.

The big producers will help finance exploration as they hunt for more gold.

The high gold price is signalling to the market to provide more supply. Gold miners also need to replenish their resource base.

It’s also likely that big gold firms will gobble up smaller players with prospective ground.

One candidate I saw bandied about is Antipa Minerals ($AZY).

Antipa is a very early stage gold project out in Western Australia.

One broker suggests Greatland Resources ($GGP) will go for it.

GGP is a new stock to the ASX. I don’t know much about it. I asked Hedley Widdup, CEO of resource fund Lion Selection Group ($LSX), for his thoughts…

He tell us…

“Antipa has a huge ground position, and the crown jewel is a multi-million ounce resource less than 50kms from an operating process plant.

“That plant used to be tired and unloved but has recently fallen into the hands of Greatland Gold, who have listed on ASX and given it a new life. The formula for new life for Telfer has a lot to do with adding ore.”

Thank you, Hedley.

That said, I don’t want to hold a stock just because it could be a takeover offer. You run the risk of getting stranded.

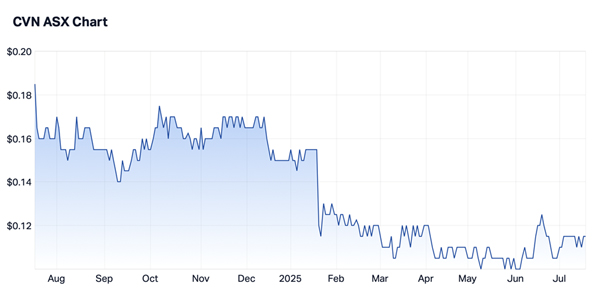

It’s happened to me before, with a stock called Carnavon Energy ($CVN).

It owns an offshore energy project in WA waters. There’s oil and gas there, and lots of it.

But CVN doesn’t have the financial muscle to bring it into production alone. It’s relying on a joint venture.

As it stands, CVN is stuck, as is the share price…

|

|

|

Source: Market Index |

CVN was rumoured to be a takeover target a while ago. But nothing’s happened in the meantime.

You should know one thing about me, at least in the stock market.

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.

I’m impatient.

I also like to have a known “catalyst” up ahead whenever I can find out.

CVN could get a takeover bid (the cash and assets do make it compelling)…but we just don’t know when or if at all.

It could still be drifting along in a year…or 2…or 3.

It’s amazing how many commodity stocks actually do this.

So…

For any takeover idea, I like to know if the project can get going, if a bid never materialises.

Gold projects like AZY are better positioned on this front than energy projects.

Oil and gas prices are ok, but not enough for juicy rich profits like we can see with gold currently.

That means there is more for potential investors and financiers to slobber over when it comes to gold, and long term structural tailwinds to go with it.

Energy is a more complicated story, because of climate change concerns and the encroachment of renewables and now nuclear into the energy mix.

There are also more gold producers in Australia to gobble up juniors than there are big energy firms.

If you’re keen to explore merger and acquisition opportunities, I suggest focusing on gold. That just seems the highest probability thematic currently.

After that would come copper, if you can find a decent project, which is the hard part. Rare earths are tricky for this reason too.

However, truth be told, I’m not the best man to guide you here.

That honour goes to my colleague James Cooper, geologist and all round mining guru over at our resource advisory, Diggers and Drillers.

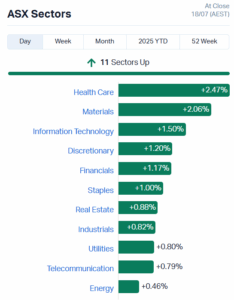

It looks like the recent surge in commodity stocks (think Lynas!) has his phone ringing off the metaphorical hook. His inbox is exploding with client enquiries.

That tells me investor interest is heating up here. I’d urge you to think along the same lines.

You can check out James’s work here.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

|

|

|

Source: Tradingview |

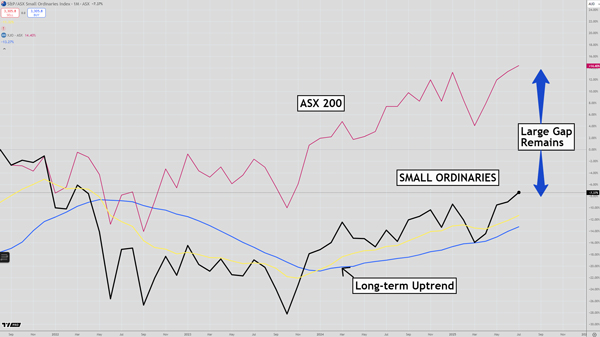

The chart above is comparing the returns in the S&P/ASX Small Ordinaries Index [ASX:XSO] to the S&P/ASX 200 Index [ASX:XJO] since the small ordinaries peaked in late 2021.

We have seen a serious underperformance of the Small Ordinaries since the crash in smaller stocks scared off investors from the speculative end of the market.

But that situation is changing.

With the ASX 200 at a new all-time high, we are starting to see the smaller end of the market play catch up.

The large gap between larger and smaller stock performance remains, but there is now a solid uptrend in place in smaller stocks and they are starting to outperform.

As long as the ASX 200 can maintain current strength, I think the large gap between smaller and larger stock performance will continue to shrink.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps