Private banks report a sharp increase in bad loans and provisions in Q1FY26 due to agriculture and small-ticket loan stress

| Photo Credit:

ROY CHOWDHURY A

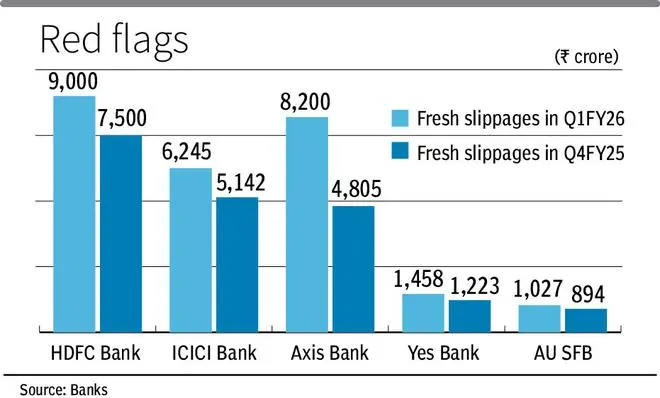

Large- and mid-sized private banks reported a sharp hike in slippages or bad loans and provisions in Q1FY26, due to stress emanating from agriculture loans and unsecured small ticket loans.

Axis Bank’s fresh slippages or bad loans spiked 71 per cent sequentially to ₹8,200 crore in Q1FY26. Upgrades and recoveries fell to ₹2,147 crore in the reporting quarter from ₹2,790 crore in Q4FY24, while write-offs were lower sequentially at ₹2,778 crore. Loan loss provisions rose to ₹3,900 crore in Q1FY26 from ₹1,369 crore last quarter.

The lender said its “prudent application” of technical parameters for recognising slippages and consequent upgrades impacted reported asset quality parameters. It said that “technical impact” is largely restricted to cash credit and overdraft products and one-time settled accounts. Axis Bank’s MD, CEO Amitabh Chaudhry said, apart from the technical change, if one compares the current quarter with the previous quarter, there is an unusual impact coming from agriculture NPAs.

HDFC Bank’s asset quality showed some deterioration, with fresh slippages rising to ₹9,000 crore in Q1 from ₹7,500 crore last quarter. The bank’s CFO Srinivasan Vaidyanathan said slippages came from the agriculture sector mainly, but did not elaborate details on other loans that slipped into the non-performing asset (NPA) category.

Having made gains of ₹9,130 crore from stake sale in HDB Financial Services’s IPO, HDFC Bank said it is a prudent time to create floating provisions of ₹9,000 crore and additional contingent provisions of ₹1,700 crore in Q1. The lender, however, specified that these additional provisions are “not specific to any portfolio, nor meant for any specific anticipated risks, but act as a countercyclical buffer”.

ICICI Bank, too, saw fresh slippages rising to ₹6,245 crore in Q1 from ₹5,142 crore last quarter. Retail and rural loans, including NPAs from the Kisan credit card portfolio, accounted for ₹5,193 crore of fresh slippages in Q1.

“Slippages in absolute amounts have risen in line with the higher loan book base. We are continuing to see slippages from the unsecured and microfinance segments. Management commentaries also point to a rise in slippage from the MSME, commercial vehicle segments. The slippage is normalising and likely to remain higher than we saw in the last few years,” said Anil Gupta, senior VP and co-group head, ICRA.

Published on July 20, 2025